Dividends

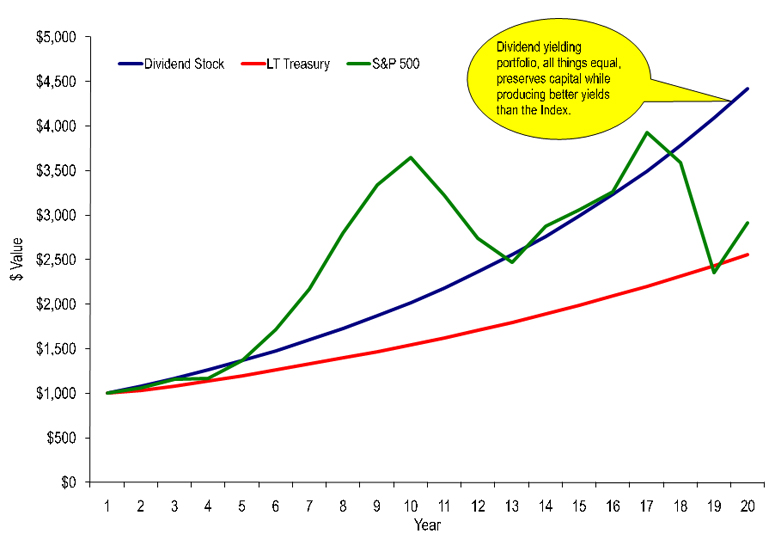

We believe a portfolio of dividend stocks is likely to well outperform the S&P 500 Index and returns from Treasuries over a 20 year period. We would argue that a dividend paying portfolio also has limited downside risk as the companies able to pay dividends generally have reached at or near their long term growth expectations, are generally more stabilized, under leveraged, and more secure investments than “growth companies.”

According to our analysis, a $1,000 principal investment in a dividend paying stock, with a 3% annual dividend yield growing at 5% per year, and modest 5% annual stock price appreciation, would grow to over $4,000 (342%) at the end of 20 years. This return compares to just over 200% for Treasuries, and a 20 year actual historical return of 191% for the S&P 500. Don’t forget, as the chart indicates, the S&P 500 has been incredibly volatile over the past 20 years as well.

Returns Comparison: Dividends vs. LT Treasuries vs. S&P 500

Source: Catherine Avery Investment Management LLC; Yahoo Finance; As of May 13, 2010.

Below are the assumptions we made when calculating our comparison chart:

- Dividend stock: 3% annual dividend yield, 5% annual dividend yield growth, 5% annual stock price appreciation.

- LT Treasury: LT Treasury Composite from May 13, 2010 (4.12%), 2% annualized growth rate (assumes Treasuries reach 6% in 20 years)

- S&P 500: Actual 20-year historical performance of the S&P 500.

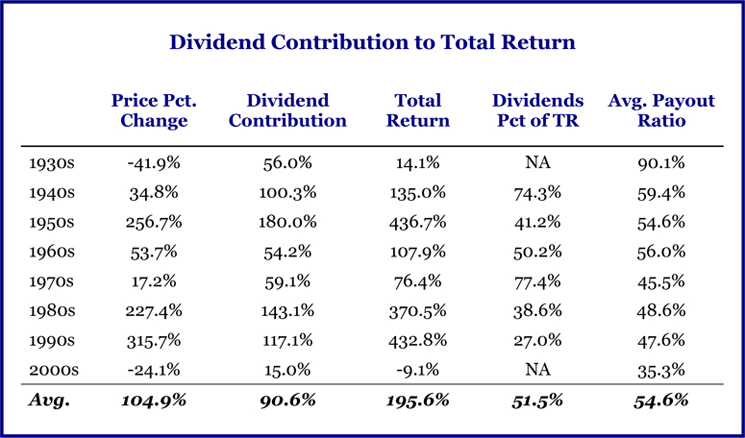

Dividend Contribution To Total Return

At CAIM we’ve always touted the plusses of dividend paying stocks.

As their name suggests, dividend-paying stocks are stocks that pay you an income stream. It’s a great way to get paid now while waiting for your stocks, as a whole, to grow. All of this makes these stocks ideal for CAIM clients, women and baby boomers approaching retirement, who want to maximize their investments and maintain a steady stream of income. Dividend paying stocks provide them with the necessary growth to keep up with inflation, as well as a cushion i.e. the quarterly dividend-payment, which helps your portfolio grow even when stocks are out of favor.

A couple of solid studies prove the long-term success of dividend paying stocks.

A recent Barron’s study called “10 for the Money” notes that over a 20-year period dividend stocks often outpace the market on a risk adjusted basis, offering stable earnings and dividends investors can count on more than capital gains or price appreciation. Also, while they don’t rise as much in whiplash rallies, they also go down less when the market buckles.

There’s also the potentials of dividend reinvestment. In his 2003 article “Dividends and the Three Dwarves,” in the Financial Analysts Journal, Robert Arnott concludes that, over a 200-year period prior to 2002, reinvested dividends were far and away the main source of real returns from stocks. In fact, of the 7.9% return in stocks, 5% came from reinvested dividends, 1.4% from inflation and only 0.6% from rising valuation levels and 0.8% from growth in dividends.

The chart below highlights the importance of the dividend to an investments’ total return.

Source: Strategas Research Partners LLC.